[ad_1]

Yes, it’s that time of year again. The new year is upon us and we all need to start gathering tax documents. Fun stuff, right? And if you’ve invested in bitcoin or sold bitcoin, then things get really fun.

The below list of items is meant to help you understand the most critical aspects for tax filing when it comes to bitcoin. And it should be noted that this specifically covers U.S. taxes (though U.K. regulations are very similar).

Here’s what you need to know:

1. Bitcoin Is Taxed As Property

That’s right, just like stocks, bonds or real estate. Although often used as currency, it is not treated like a currency for tax purposes. Every single time you sell, spend or exchange bitcoin, you have executed a taxable transaction. You have a capital gain or less every time you dispose of your bitcoin, unless it is by gifting it to someone.

I know what you’re thinking. Well, I know what I’m thinking, anyway: This necessitates a lot of detailed record keeping. In order to compute capital gains and losses, you need to know your original cost basis. Now, crypto exchanges will keep a history of all of your transactions, but they won’t be reporting your cost basis to you on any regular basis. In addition, if you’ve moved coins or taken self-custody, you really need to keep track of all your coins and their original costs. I’m thinking a nice Excel spreadsheet. And stay up on it regularly. Your tax accountant will be pleased.

2. Bitcoin Received From Mining Are Taxable

If you’re mining bitcoin, every coin you mine is taxable as ordinary income. Don’t let the word “ordinary” fool you. Ordinary income, in IRS parlance, is taxed at higher rates than long-term capital gains are. (“Long term” in the U.S. means you’ve held the asset for one year or longer.)

Not only is mining taxed as ordinary income, but also as self-employment income, so you’ll owe social security and medicare taxes as well.

Now, you get to write off all of your expenses associated with the mining operation, such as electricity, which is a big one. You can also write off the cost of the mining rigs over several years, and in some cases take a deduction for the entire cost in year one. That’s a nice benefit.

How do you tally up and report how much income you’ve generated, in U.S.-dollar terms? The IRS regulations say your income is the fair market value of the bitcoin you mine on the day you receive it. Thus, each day you have more income. Again, here comes a great Excel spreadsheet opportunity.

Now, if you mine bitcoin as a hobby, you can simply report the income on your tax return as “other income,” and as such, won’t pay self-employment taxes like social security and medicare. The downside, however, is that you won’t be able to write off any expenses against the income. If you do want to take the deductions, report the income and expenses on U.S. Schedule C.

Note: If you report income from mining, you now have a cost basis for the coins to use against future capital gains — more record keeping.

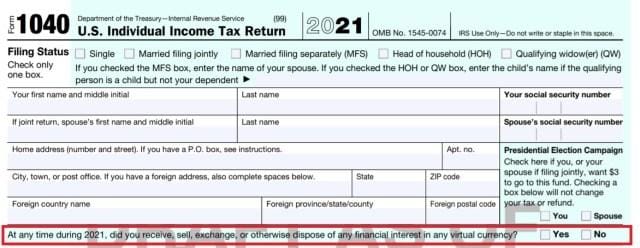

3. How To Answer “That Question” On Top Of Form 1040

Above is what the draft version of the 2021 Form 1040 “crypto question” looks like. Note that this is a slight change from 2020, when the question also included “sending” any cryptocurrency. If you only purchased bitcoin during 2021, you can answer “No.”

“At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency?”

So, do you have to answer this? Yep, and you should answer it honestly. Will it get you audited? Probably not, since only .45% of taxpayers with incomes between $75,000 and $200,000 were audited in recent years. If you answer the question “Yes,” the IRS may look at your return and see that some bitcoin transactions are reported, capital gains and mining income, mainly.

4. Being Paid In Bitcoin, Or Paying In Bitcoin, Are Taxable Events

If someone pays you for your services in bitcoin, that is taxable as self-employment income. Your income is the U.S. dollar value of the coins you received on that day of payment. Like with mining, you then have a cost basis for those coins.

Likewise, if you pay someone else for their services with bitcoin, you have just disposed of some coins. As such, you have either a capital gain or capital loss on the transaction.

5. Paying For Starbucks With Bitcoin Is A Taxable Transaction

Though Starbucks makes some amazing drinks, you really shouldn’t pay for them in bitcoin because, yes, it is a taxable transaction, every time you spend your bitcoin. Your next question: “Is there a de minimis exception for such a small transaction?” No, not at this time.

And that, in a nutshell, is the problem of having a property that acts like a currency, and a currency that acts like a property. There is not yet a user-friendly system of taxation to handle all Bitcoin transactions fluidly.

6. You Can Deduct Losses From Trading Bitcoin, But…

Capital losses from trading any asset can be used to offset capital gains, whether the gains were from bitcoin, stocks, real estate or any property. That’s the good news. If you’ve suffered some losses in bitcoin, but had gains in stocks, or vice versa, you can offset.

If you didn’t have any gains to offset, or your losses are greater, you can still deduct some this year. Taxpayers can deduct up to $3,000 per year in capital losses that exceed your gains. That’s not much, I know. However, you can carry these losses forward to deduct against profits in future years.

7. Exchanging Bitcoin For Other Cryptocurrencies Is Taxable

A like-kind exchange is where one asset is exchanged for another similar one, typically two parcels of real estate. But there is no provision for “like-kind” exchanges for cryptocurrencies. This tax provision enables the seller to defer paying capital gains taxes on the profit until a time when the second asset is sold.

8. Do Bitcoin Exchanges Report Transactions To The IRS?

Cryptocurrency exchanges do not report sales of assets in the same manner as do stock brokerages. Every sale of stock or mutual funds is reported, so you must show each sale on your tax return, even if the sale doesn’t result in a gain. Tax reporting by cryptocurrency exchanges is, at this time, a mixed bag. And that is something that the U.S. government wants to wrap its arms around.

For example, Coinbase, the largest U.S.-based exchange, will not be issuing Form 1099-K or Form 1099-B to report sales of cryptocurrency. Thus, none of your sales proceeds are being shared with the IRS. You have the sole responsibility of reporting all of your sales proceeds and cost basis. The only transactions that Coinbase reports are rewards or fees that you may have earned during the year, and only if they exceed $600. Those are reported on form 1099-MISC.

Gemini takes a completely different approach. The company views itself as a third-party settlement organization (TPSO) and as such files Form 1099-K for certain transactions. (A 1099-K is usually filed by merchant services companies to report funds sent to retailers.) Gemini will only report if your sales of digital assets exceeded 200 transactions in a year and exceeded $20,000 in proceeds.

Binance, a Malta-based company, does not report to the IRS, and is actually no longer serving U.S.-based traders. Binance had previously issued Form 1099-K to certain traders.

9. Generally, You Don’t Have To Pay Taxes On Bitcoin Donations To Charity

Though by giving your bitcoin to a charity you’ve actually disposed of it, you will generally not pay taxes on the transaction, even if the coins have gone up in value. Even better, you may be able to take a deduction as a charitable contribution in the amount of the fair market value on the date of the donation — win-win. You can’t say that very often with regards to taxes.

If someone gifts you some bitcoin, good for you. Best of all, it’s not a taxable transaction to you — a win-win, again. When you dispose of the coins in the future, your cost basis will be the same as the person’s who gifted it to you. So, in that case, a little communication will be necessary.

10. Key Points To Remember

Taxes can get pretty complicated with bitcoin. Key points to remember:

- Every time you dispose of bitcoin, it triggers a taxable event

- Keep accurate, thorough records of all buys and sells

- Don’t expect your bitcoin exchange to give you a nice, neat yearly summary

- Seek professional help (tax help that is) in an accountant who knows the bitcoin landscape

This is a guest post by Rick Mulvey. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

[ad_2]

Read Full Story

Microsoft Pledges Long-Term AI Investment in the UK

April 9, 2024

Leave a reply

Bitcoin News

-

Ethereum on Track for Profitable Year Driven by DeFi Boom

April 19, 2024