[ad_1]

The below article is part of a larger series on Bitcoin mining around the world compiled by the team at Arcane Research.

Bitcoin miners have an outsized presence in Georgia, considering the country’s tiny geographical size and small population. What makes this former Soviet republic so attractive to bitcoin miners?

I lived in Georgia for six months and have first-hand knowledge of its bitcoin mining industry. Using that knowledge and a range of available data, this article will answer that question and more.

How Large Is Georgia’s Bitcoin Mining Industry?

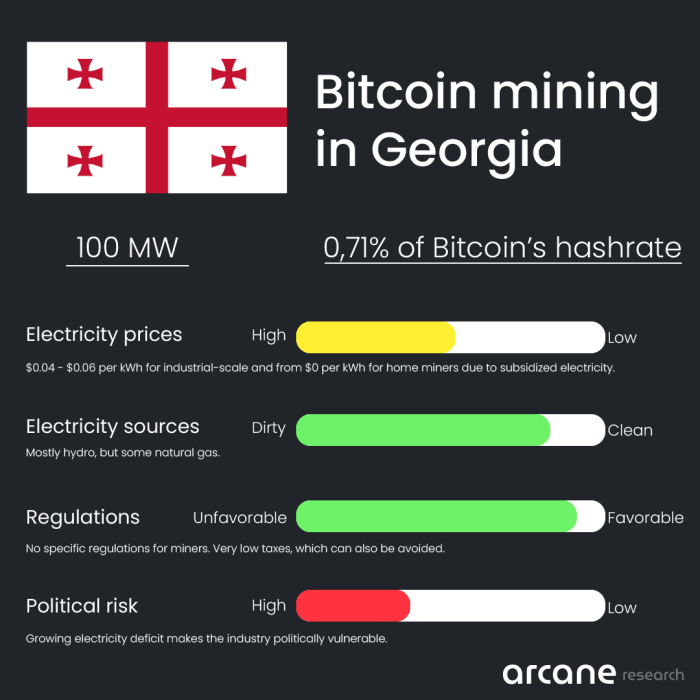

According to the most recent edition of the Cambridge Bitcoin Electricity Consumption Index (CBECI) mining map, Georgian miners produce 0.18% of Bitcoin’s hash rate. But I believe the country’s actual bitcoin mining capacity to be far higher than this estimate. Why?

CBECI uses data from mining pools to estimate the geographic distribution of miners, but the sample only includes four pools that together account for 34% of Bitcoin’s total hash rate. CBECI openly admits that its samples may not be sufficiently representative, but it’s still the best estimate we have.

If Georgian miners are not heavy users of the pools included in CBECI’s sample, their geographical share of Bitcoin’s hash rate will be underestimated.

During my stay in Georgia, I befriended miners and often visited mining facilities. These miners have told me that Georgia has at least 125 megawatts (MW) of cryptocurrency mining capacity. I have identified 62 MW from industrial-scale data centers. The remaining 63 MW should then come from lots of small, amateur setups scattered around the country in homes, garages and abandoned warehouses and factories.

As of February 15, CBECI estimates that the Bitcoin network draws 14 gigawatts (GW) of electricity. Based on information from Georgian miners, I estimate that 100 MW of Georgia’s 125 MW total cryptocurrency mining capacity is dedicated to Bitcoin and that Georgia’s hardware is as efficient as the network average. In that case, Georgia should produce about 0.71% of Bitcoin’s total hash rate, multiples higher than CBECI’s 0.18% estimate.

Who Mines Bitcoin In Georgia?

Since 2016, the international bitcoin mining giant Bitfury has operated a 55 MW facility in the outskirts of Georgia’s capital, Tbilisi. The facility consists of standard halls filled with air-cooled machines as well as containers with immersion cooling systems — an advantage in Georgia, where summer temperatures often spike above 40° C.

Bitfury’s facility in the outskirts of Tbilisi. Source: Andrew North for NPR.

In addition to Bitfury and one other industrial-scale mining facility, thousands of Georgians run smaller, amateur setups scattered around the country. Some mountainous regions have higher concentrations of cryptocurrency miners because of electricity subsidies. Cheap electricity coupled with few other opportunities has led as many as 200,000 Georgians to get involved in cryptocurrency mining, as estimated by The New York Times in 2019. Many amateur miners mine other cryptocurrencies aside from bitcoin, like ether or litecoin.

Electricity Mix

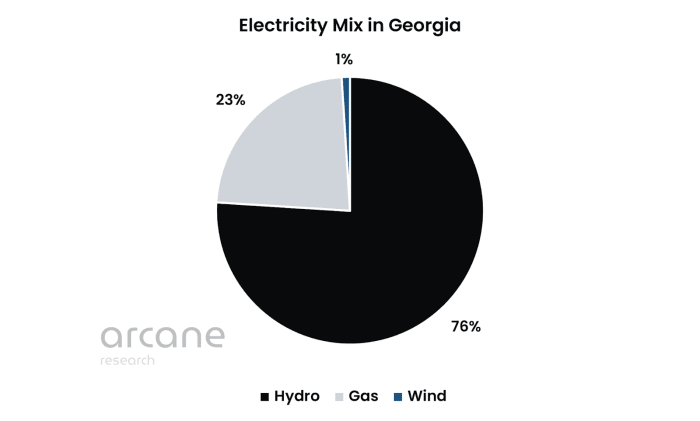

Mountainous Georgia has access to enormous amounts of hydroelectric power. Go for a drive through the country, and you will pass countless rivers and several sizable hydropower plants. According to Our World In Data, the country generates 76% of its electricity from hydroelectric sources, 23% from natural gas and 1% from wind.

Source: Our World in Data

One-third of the electricity produced in the country comes from the Enguri hydroelectric power plant with an operating capacity of 1,300 MW.

Enguri hydropower plant. Source: Milena Mitagvaria, 2016.

Currently, Georgia has only exploited about 25% of its potential for electricity generation. The untapped potential mostly comes from hydro, but wind and solar also have potential.

Even though Georgia has massive energy potential, the buildout of new generation capacity has been insufficient to accommodate the rising electricity demand in recent years. During the dry winters, the country doesn’t generate enough electricity and resorts to importing electricity from Azerbaijan and Russia. I will detail why this electricity deficit can be problematic for bitcoin miners later.

Electricity Prices

Electricity is generally cheaper in Georgia than in most countries. Georgian miners have told me that industrial-scale miners can achieve a price of around $0.04 to $0.06 per kilowatt hour (kWh) — slightly above the median electricity price in the industry, pre Bitooda.

Electricity has become more expensive in Georgia over the last few years. According to Georgian miners I’ve spoken to, existing industrial-scale miners that were early entrants in the electricity market could secure long-term contracts priced cheaply, and it’s unlikely whether new entrants will be able to secure such favorable-priced power contracts.

Electricity is cheaper in remote, mountainous regions because of government subsidies. In some areas, like the disputed area of Abkhazia, electricity is free of charge. Still, industrial-scale miners can’t expect to enjoy subsidized electricity, certainly not in the long term.

Rising Electricity Deficit

The country’s failure to build new generation capacity, coupled with rising electricity demand — partly caused by the unexpected growth of cryptocurrency mining — is causing electricity prices to rise. Until the country develops more generation capacity, electricity prices will continue increasing.

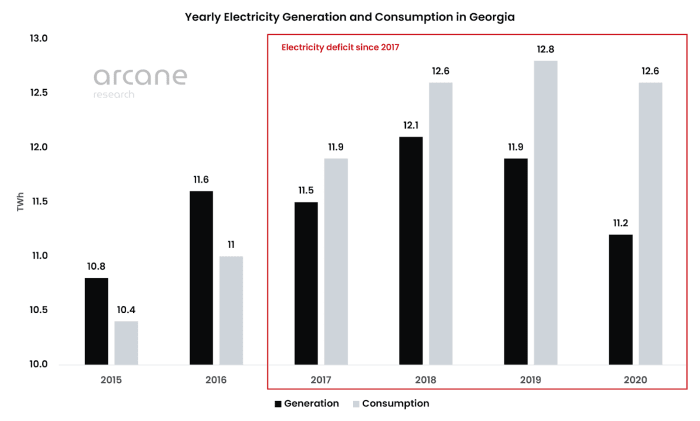

We can see the imbalances between generation and demand in the chart below. Georgia has historically been an electricity exporter but has, from 2017, been a net electricity importer.

Source: International Energy Agency (IEA)

Bitfury opened its 55 MW facility in 2016, the last year Georgia enjoyed an electricity surplus. Based on its 55 MW capacity, Bitfury’s annual electricity consumption should be around 0.5 terawatt hours (TWh) — corresponding to about 4% of the country’s total electricity consumption. This amount of electricity consumption should undoubtedly affect the market and is part of why the country has seen a growing electricity deficit since 2017.

Adding in the vast number of smaller amateur miners, the cryptocurrency mining industry’s total annual power consumption in Georgia might be almost 1.1 TWh, assuming a total capacity of 125 MW. If this estimate is correct, nearly 9% of Georgia’s electricity consumption goes to cryptocurrency mining, which undoubtedly makes the industry partly responsible for the country’s growing electricity deficit.

Potential For Development Of New Electricity Generation

IEA estimates that the electricity deficit will continue growing, so to avoid upwards spiraling electricity prices, Georgia must develop new hydropower plants. The potential here is enormous, but a general opposition among the population currently holds back new hydropower projects. Many Georgians have ties to regions that new hydro projects will dam up. During my six-month stay in Georgia, I witnessed at least two large protests against new hydro projects. In addition, hydropower plants are enormous infrastructure projects that take several years to develop.

Protest in Kutaisi against Namakhvani dam, 28 February 2021. Source: Mariam Paichadze, Fair Energy Politics Collective.

In addition to its hydro resources, Georgia has excellent potential for building out wind power. The general public doesn’t oppose wind projects as much as it does hydro projects. In addition, wind farms can be built much quicker than hydropower plants. Currently, Georgia only has one wind farm with 20 MW, but the potential is enormous, and several projects are under planning.

A potential growing share of weather-dependent wind power in Georgia’s electricity mix will increase the need for electricity consumers to become more adaptable and regulate their demand after the wind farms’ uncontrollable production patterns. Bitcoin miners are interruptible, meaning they can interrupt their power consumption without additional costs, making them excellent candidates for demand response. As explained by Nic Carter and Shaun Connell in this article, Texas bitcoin miners are helping integrate wind and solar, and they might be able to do the same in the country of Georgia.

GSE, the operator of Georgia’s transmission system, estimates that the country’s generating capacity will more than double to 8,767 MW by 2029, but IEA believes these projections to be unrealistic.

Although the potential for new generation capacity is enormous, I fall in line with the IEA in that it’s unlikely that the country will vastly increase its electricity generation capacity in the next few years, and its electricity deficit will most likely grow even further, increasing electricity prices.

Regulatory Environment

Georgia has low taxes and a very relaxed regulatory environment. The country’s business friendliness fascinated me long before I decided to move there, and I wondered how a former Soviet country became such a libertarian enclave.

During the 1990s, in the chaos that unfolded after the Soviet Union collapsed, Georgia went through some hard years that included a civil war. The apocalyptic period spurred a revolution in 2003, leading to the election of Mikheil Saakashvili as president.

Having been locked behind the iron curtain for 70 years as part of the Soviet Union, the Georgian people thirsted for freedom. The newly-elected Saakashvili’s procedure was to remove all regulations and taxes unless they were considered absolutely essential. They effectively cut 80% to 90% of all regulations in a few months, lifting away an enormous bureaucratic burden from the country’s shoulders.

The reform was a massive success, and the country’s economy has been among the fastest-growing in the world since. In 2019, Georgia ranked seventh on the World Bank’s Ease Of Doing Business Index, higher than the likes of the United Kingdom, Germany, Norway, Sweden and Australia. Georgia’s transformation is awe-inspiring, considering it was extremely poor and plagued by lawlessness just 20 years ago.

Having little bureaucracy to deal with is helpful for any business, but the most important regulatory aspect for a bitcoin miner is the ease of getting electricity and how the electricity market is regulated.

In the past decade, Georgia’s electricity sector has been transformed from a vertically-integrated single-buyer structure into an unbundled system with significant private sector participation in generation and distribution. The country is in cooperation with the EU developing a new market model with more competitive and transparent rules for power trading, and its goal is to meet all EU power sector standards by 2025. These initiatives will deregulate the electricity market even further.

In Georgia, anyone is free to buy electricity from anyone. Bitfury has a direct power purchasing agreement with a power producer and owns a substation, allowing it to avoid dealing with the distribution companies, saving on distribution charges.

A Tax Haven For Bitcoin Miners

Another regulatory advantage in Georgia is low taxes, specifically on cryptocurrencies. There are no specific regulations on cryptocurrency mining or trading, so miners can operate as they please. Individuals in Georgia are exempt from taxes on mining or trading cryptocurrencies, but businesses generally have to pay a 15% corporate income tax and 18% value-added tax (VAT).

For export businesses, it’s possible to avoid most taxes by setting up the business in one of Georgia’s four free economic zones, specifically designed to minimize taxes for export companies to help them successfully compete in global markets. Bitfury’s facility is located in the Tbilisi Free Zone, letting it avoid corporate taxes, VAT, import taxes and other fees.

These free economic zones are highly relevant for bitcoin miners since they compete against miners worldwide, and the only way to stay long-term competitive in this industry is to minimize costs, including taxes.

The World Bank ranks Georgia as the third least-tax-burdened country globally. The low taxes in general, coupled with the possibility of avoiding them altogether if structuring a business the correct way, means that Georgia is a tax haven for bitcoin miners.

Political Risk

Yes, the country has little bureaucracy, low taxes and a relaxed regulatory environment. Still, bitcoin mining is an industry that is vulnerable to political risk since it’s often used as a scapegoat in countries with fragile grid systems. We have seen that happen in many countries before, like in Kazakhstan, Iran and Kosovo.

Assuming that the cryptocurrency mining industry in Georgia draws 125 MW, the industry uses around 9% of the country’s electricity. IEA‘s estimate is even higher at 10% to 15%. Regardless of whether it’s 9% or 15% i,t’s a substantial amount, which increases the country’s reliance on imports in the winter and can potentially weaken its energy security and increase electricity prices for the average consumer.

The vast size of the industry compared to the country’s small size overall may put a barrier to the industry’s potential growth. Not only because more mining will increase electricity prices and make new mining projects unprofitable, but also because the government might turn against the industry if it becomes advantageous for it.

The political risk is higher in some regions of the country than in others. Because the governments in mountain regions subsidize electricity, thousands of people have started small home mining operations, allegedly leading some towns to consume four times more electricity than expected, which has led to efforts to reduce mining. One such effort saw churchgoers urged to swear an oath to St. George that they would not mine cryptocurrencies.

Especially in the disputed area of Abkhazia, there have been problems with the grid, as it has periodically suffered rolling blackouts during the last year. These problems were caused mainly by their biggest hydropower plant being shut down for maintenance for three months and the higher-than-usual electricity demand from countless small home mining operations. The rolling blackouts have led to public anger in the region, which is not sustainable since miners are easily blamed. In Abkhazia, the government relies on subsidizing electricity to gain support. Mining threatens this strategy, so it’s no surprise that the government cracks down on mining in areas with subsidized electricity.

Conclusion

With its cheap and clean hydroelectric power, tiny, mountainous Georgia has attracted a large bitcoin mining industry with industrial-scale operations and countless small home mining setups.

The country’s relaxed regulatory environment and low taxes have helped it rank seventh in the World Bank’s ease of doing business index, making the country attractive not only for bitcoin miners but also for any business.

Georgia is a strong cryptocurrency adopter, and people generally have a positive attitude toward the emerging asset class. Nevertheless, the political risk is considered high because of the country’s significant and growing electricity deficit, incentivizing the government to crack down on miners. In addition, home mining operations challenge the government’s electricity subsidy strategy in some areas of the country. Therefore, the country’s favorable regulations for miners may change in the future.

Since Georgia has recently become dependent on electricity imports, there might not be room for more bitcoin mining until new generation capacity is developed. Still, opportunities exist for miners to contribute to building out new electricity generation, especially wind power.

This is a guest post by Jaran Mellerud. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

[ad_2]

Read Full Story

Microsoft Pledges Long-Term AI Investment in the UK

April 9, 2024

Leave a reply

More News

-

Crypto Giant Grayscale Launches ETF On “Future Of Finance”

February 2, 2022 -

Crypto Mom On BlockFi, $100M Fine Seems “Disproportionate”

February 15, 2022

Bitcoin News

-

Ethereum on Track for Profitable Year Driven by DeFi Boom

April 19, 2024