[ad_1]

Bitcoin is the hardest form of money that has ever been invented. The enthusiasm that has emerged around this technology has been slowly revitalizing our society. The Bitcoin space is filled with hope and joy. This contrasts with the low morale of the fear-driven fiat world, where a majority of people feel unhappy and dissatisfied with their lives.

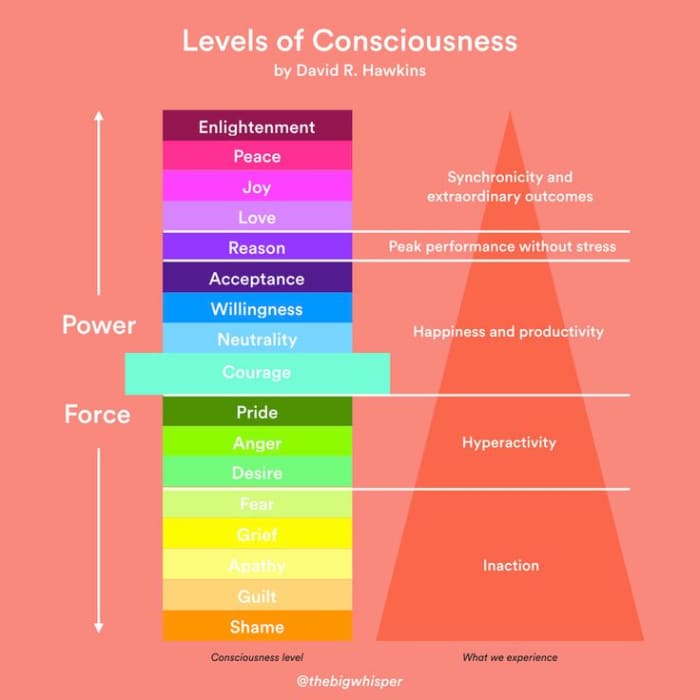

It is clear that money has a large influence on our mental and emotional state. It carries certain energies that could affect every aspect of society, both positively and negatively. David R. Hawkins, a renowned psychiatrist and physician who studied the science of human consciousness, documents how our consciousness evolves through different stages.

In his book, “Power Vs. Force: The Hidden Determinants Of Human Behavior,” Hawkins maps out the scale of consciousness within a range from zero to 1,000. These determinants are categorized as shame (rated lowest at 20), guilt, apathy, grief, fear, desire, anger, pride, courage, neutrality, willingness, acceptance, reason, love, joy, peace and enlightenment (rated highest at 700 to 1,000).

“Map of Consciousness” by David R. Hawkins (Source)

In this article, I will explore how Bitcoin is a technology that can help humanity raise its consciousness, allowing us to improve our psychological well-being. But, before we dive in, let’s look at the energetics behind the legacy financial system.

Denial Of Self-Agency

Fiat money is based on trust in a central authority. This setup, at its foundation, negates self-agency; people are made to externalize responsibility for their own lives, projecting that onto institutions and denying their capacity to take care of themselves.

Interfaced with the centralized national currency, institutions like Church and State perform a role of a trusted third party to govern citizens’ everyday affairs.

Hierarchically-organized religions with an abstract image of a god that constantly judges and criticizes, use shame and guilt to regulate people’s motivations and desires.

“George Carlin- Religion: A Bullshit Story”

As a society becomes more secular, a political system takes over the Church’s moral authority. A wealthy few combine market forces with electoral politics to create an illusion of democracy.

(Source)

In this system which exerts control under the guise of representative government, humans are treated like cattle. They are being reduced to functioning primarily from animal instincts, becoming less conscious.

Emergence Of Power

Hawkins places courage at level 200, defining it as the critical point in one’s evolution of consciousness, where power first appears. Defining power as something that supports life, he differentiates it from force:

“Force always moves against something, whereas power doesn’t move against anything at all. Force is incomplete and therefore has to be fed energy constantly. Power is total and complete in itself and requires nothing from outside. It makes no demands; it has no needs. Because force has an insatiable appetite, it constantly consumes. Power, in contrast, energizes, gives forth, supplies, and supports. Power gives life and energy—force takes these away.”

(Source)

Courage is generated when an individual uses his or her own initiative freely. This activates the intelligence of the heart. This consciousness is the power that is accessible uniquely by us human beings. It helps us to go beyond a survival-based existence and allows us to experience higher emotions that are not available to other species.

The fiat system prevents the emergence of this heart’s intelligence. By denying each person’s will to self-determination, it keeps our state of being at a low level.

Attacks On The Individual

With economic incentives that give them the advantage, those who control money printing condition each person to view himself or herself as a part of the group, not as an individual.

In the name of “for the good of the society,” the public is made to neglect its own needs and desires to cater to the private agendas of a small minority at the top of the hierarchy. By punishing anyone who tries to act out of his or her own best interests as being too “selfish,” the system enforces conformity.

In this digital age, it seems like assaults on the value of individuality are being carried out on social media. With the help of tech giants’ censorship and algorithmic control, billionaires behind the managed democracy have launched identity politics. This old tactic of divide and conquer separates people based on gender, race, ethnicity or sexual orientation, pitting one group against another to rule them all.

Puppet politicians promote the specific interests and concerns of one particular group, generating animosity and victimhood for the others. The conflict created in the electoral arena pulls people into engaging in a political battle. Aggravated by toxic tribalism, people feel their safety is threatened. They become easily triggered by survival fear and act with fight-or-flight reactions.

Mass Formation Psychosis

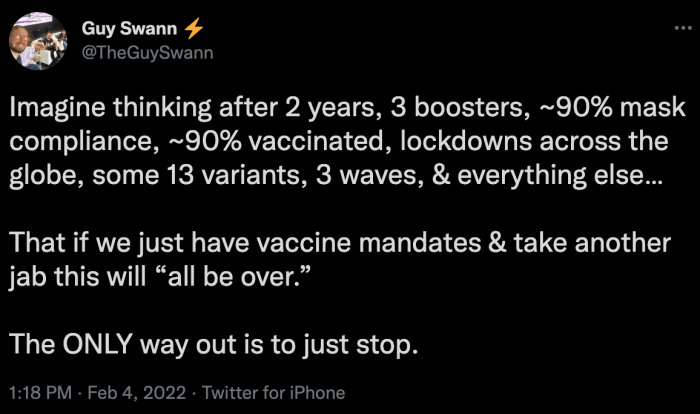

Now, in this COVID-19 pandemic, media hyped fear has pushed human consciousness further into a downward spiral. Lockdowns have created isolation and a lack of social connection, generating anxiety. As if they were placed under a kind of hypnotic spell, the general populace has begun to act like a herd, becoming obedient to authorities.

Belgium psychologist and statistician Mattias Desmet observed and explained the phenomena with his theory of “mass formation psychosis.” He analyzed how those who are affected by these psychological conditions would lose a capacity for independent decision-making and become more willing to give up their own freedom.

Dr. Robert Malone, a physician whose early work focused on mRNA technology, popularized the term on an episode of “The Joe Rogan Experience” podcast.

With slogans like, “We are all in this together,” governments and health experts around the world have been pushing a medical mandate, uniting people to serve for the interests of Big Pharma.

Hijacking The Human Mind

The “Great Reset” of the system is now underway. In July 2020, the group behind the initiatives of the World Economic Forum (WEF) published an action plan titled, “Building Back Better.” In the name of creating stakeholder capitalism and using the method of centralization, it is aiming to re-engineer the economy to create technocratic communism.

Around the vaccine passport program, efforts are being carried out to roll out central bank digital currencies (CDBCs). This monetary system, able to track and censor all transactions, could be used to launch a China-style social credit scoring system, through which human beings are trained to think and act like robots.

Meanwhile, a digital dictatorship is on the horizon. The forces that try to regress the evolution of consciousness intensify on the internet. At Davos 2020, Yuval Noah Harari spoke on the “Hacking Of Humanity” at the World Economic Forum.

In a dystopian future, technological advances such as artificial intelligence (AI) could be used to hijack the human mind, severing our connection to the intelligence of the heart. Facebook, which has over 2.9 billion monthly active users, is now developing the metaverse which is a virtual 3D reality aimed at bringing all forms of learning, socializing, collaborating and playing online. These are their stated goals, but once complete, will they be able to control our emotions and thoughts directly from the inside?

Confronting Fear With Courage

While “normies” are deeply sucked into the epidemic of madness, Bitcoiners seem not to be affected by it. Instead of living in a constant state of anxiety and despair, they remain relentlessly optimistic.

Plebs don’t easily succumb to mainstream media’s doom-and-gloom headlines. They don’t care about what politicians are doing. Their laser-beamed eyes pierce through lies and deception and they cannot be fooled by the tricks of the clown world.

Being firmly grounded in their own reality, HODLers confront fear with courage.

(Source)

The Rise Of The Self-Valued Individual

The invention of computer science has opened up a path for humanity’s ascendance. The Bitcoin white paper published by the pseudonymous author, Satoshi Nakamoto, presented a way for us to secure individuality as a foundation stone for the building blocks of what it means to be human.

Through the method of decentralization, which distributes trust across the network, new incentives have now been created that align everyone’s self interests. This allows us to begin integrating parts of ourselves that have been rejected by our society. Now, those of us who are willing, can start to claim full ownership of our property — our own independent mind, body and spirit.

A higher state of consciousness cannot be attained if we don’t first accept ourselves fully.

Without healthy self love, one can’t create a sense of happiness and joy. Only individuals who value themselves can claim their own power and produce value for others.

A network of highly self-valued individuals begins to free humanity from a state of ignorance that has been perpetuating misery and suffering. The heart of Bitcoin mining, beating every 10 minutes, transmutes the emotions rooted in the survival mechanisms of the brain into generating vitality and life. Each person attaining sovereignty helps to raise consciousness of humanity toward enlightenment, increasing love and peace for our world.

This is a guest post by Nozomi Hayase. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

[ad_2]

Read Full Story

Microsoft Pledges Long-Term AI Investment in the UK

April 9, 2024

Leave a reply

More News

-

Platypus Launches Native Stablecoin USP

December 13, 2022 -

New Hampshire Establishes Bitcoin And Crypto Study Commission

February 15, 2022 -

$ONFO token founder found dead in US State Arkansas

June 5, 2023

Bitcoin News

-

Ethereum on Track for Profitable Year Driven by DeFi Boom

April 19, 2024